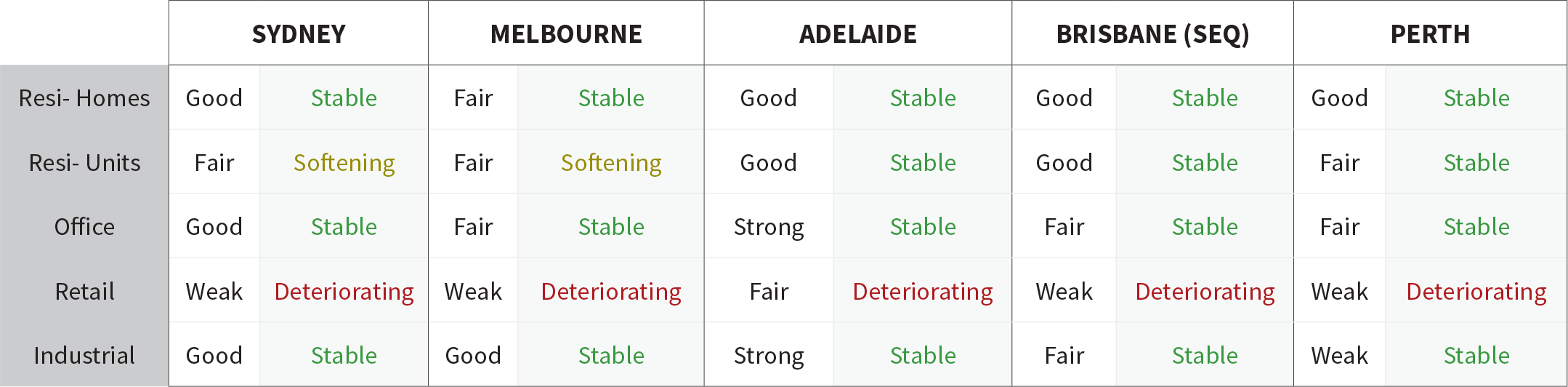

Market Update by Segments

Office market yields are softening slightly in most locations, but ultra-low interest rates, which are expected to last for the next few years, are offsetting lower returns. Demand still appears to be high for quality office space.

The Industrial sector surged forward as previous lockdowns put a brake on retail investments. According to their report, yields are tightening in all locations for both prime and secondary properties. Rents for prime properties will show little change, while secondary properties would initially see yields tighten by 50 basis points, with incentives rising slightly.

Free cash flow after all outgoings is a key consideration with any purchase or financial commitment. Longer loan terms help preserve cash flow and many institutions offer commercial property loans with loan terms in excess of 25 years. The longer the term the lower the loan repayment.

An overview of our offering

- Business funding within 24 hours

- Funding can be used for any business purpose (no supporting info required)

- No asset securities required

- Flexible funding with no penalties for early payout or commission clawbacks

- Get approved for up to $25k in just minutes.

- Access SME business loans up to $1 million

- Fitout Finance: Up to $750k, no financials up to $250k (bank statement only), no soft cost caps, up to 5-year terms

Self Employed – Lending based on accountant’s recommendation.

- Self-employed for 2 years, but financials are hindering your borrowing capacity?

- We have solutions and a lender on board specialising in self-employed.

- 2 business days turnaround for a decision.