Connected with local, national and international operators, NAI Harcourts enjoys access to opinions formed from a broad range of data sets and experiences. There are numerous business confidence and economic outlook surveys around, and the greater number of these indicate a sense of hope and enthusiasm about the year ahead, but they are also tempered with caveats of caution around the range of risks that still exist- known and unknown. So, what are some of the elements that the educated commercial market observer might like to consider. Jason Luckhardt, National Manager of NAI Harcourts shares some insights.

Market Moving Factors

• Low interest rate regime – current and unlikely to change in the short to medium term

• Government stimulus and support/ Infrastructure spend

• Net Overseas Migration (Australian Treasury forecasts)- the population effect

• The changing face of commercial property

Not intending to be an exhaustive list of factors that will shape commercial property and business landscapes, but these are some that stand out.

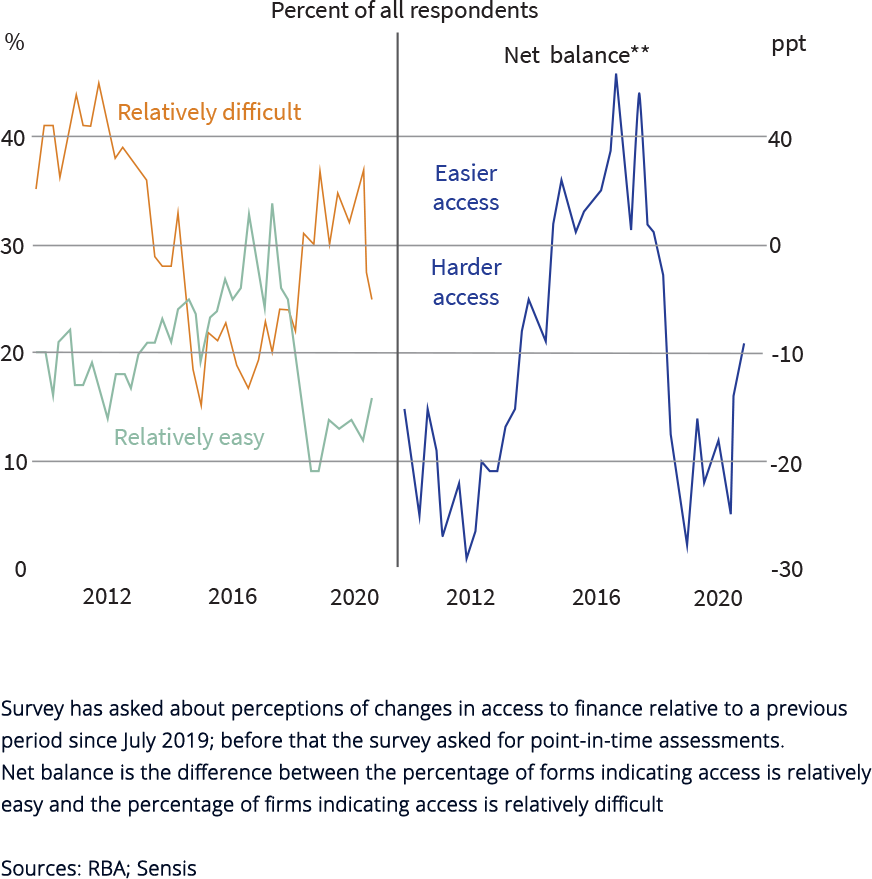

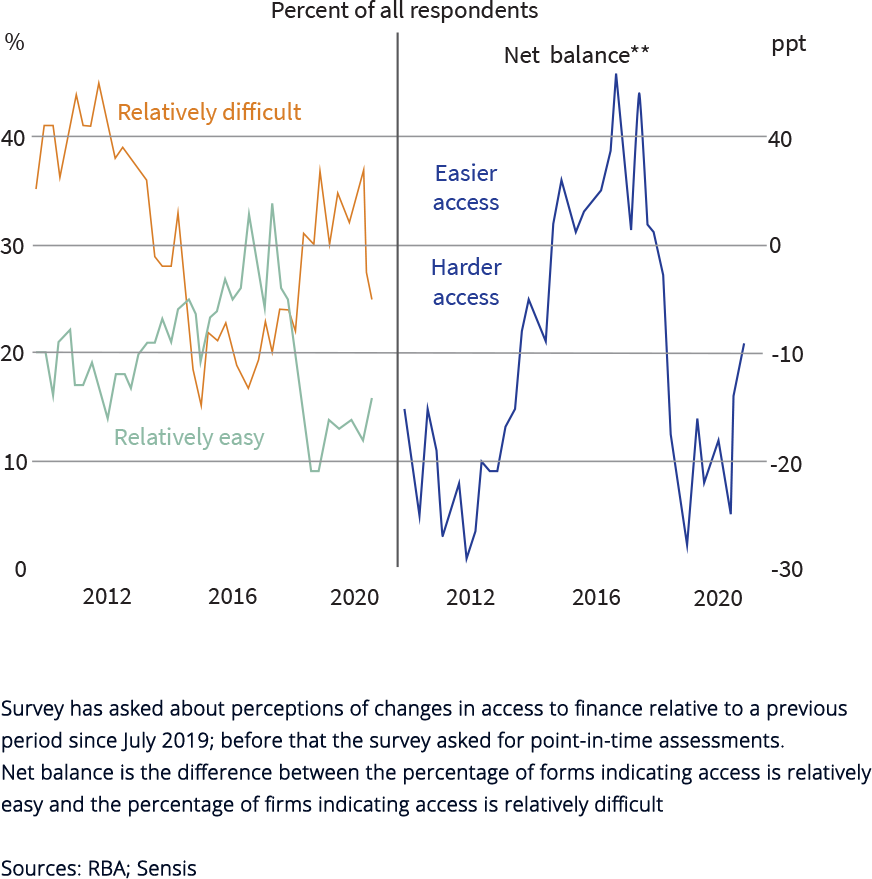

Money, and the cost of it, takes centre stage at present across global markets. The number of businesses that have suffered losses and those that were forced to close are significant but are substantially less than many predicted in the earlier stages of the 2020 pandemic cycle is Business operators have indicated higher levels of scrutiny in obtaining funds, but the resultant survival factor much higher due to the low cost associated. Business restructuring and Insolvency firms are still reporting lower levels of activity than many have predicted earlier in 2020.

|

Small Business Perception of access to finance  |

Major banks’ Funding Costs  |

The cost of funding benefits the public sector too, with Federal and State Governments also demonstrating that continued government stimulus spending is there to remain for the foreseeable future. These factors both bode well for commercial investors in the year ahead, providing that the ever-evolving story around Covid-19 from both a local and international perspective doesn’t compound any existing elements of uncertainty. Australia’s Treasurer, Josh Frydenberg, has scheduled a program of stimulus that sees $145b (2020-21) and continuing stimulus of $47b (2021-22) which indicates a decline in fiscal aid linked to expected economic resilience and recovery.

Another headline factor for Australian economic outcomes rests in the hands of our population and the trajectory attached to it. Australian Treasury forecasts that our net position relative to pre- pandemic predictions (Treasury Forecast 2029-30 Australian population) is set to be permanently lower by around 1.6 million people. Whilst lessened overseas job competition is one benefit of this statistic, participation and productivity are both headwind factors to be navigated as we will see further age factors in our workforce and upward pressure on our workforce to undertake less favourable tasks that were usually filled by migrants keen to establish employment. On a positive note, innovation and reform are highlighted headlines that indicate that we may achieve greater productivity through change, and this is where our markets are deriving great optimism in an expectation of a productivity uplift. Addressing the property and business markets is always multi-faceted in such a large island with dispersed population centres, however several key trends can be seen across the country.

Strong Industrial demand continues. A variety of factors ensures this trend to be ongoing such as: Owner occupiers accessing cheap funding, retailer innovation with multiple distribution channels holding stock offsite at cheaper rates and regional “just in time” and “just in case” supply chain logistics. This sector is also considered by Investors as one of the best plays in the current investment marketplace as indicated by the sharply dropping yields across most markets.

Retail innovation continues with the need to have more “experiential” delivery in order to attract. Shopping Malls/centres are finding activity-based operators, entertainment precincts and more innovative food offerings are all much more attractive propositions over traditional “chain store retail” that offers little variation from shop front to shop front. Look out for novelty food operators that integrate activity - darts or axe throwing bars, novelty mini-golf, ropes courses for the family and Immersive VR are just some of the new trends.

Office space has seen a slow return of workers particularly in the major centres, with many reporting large percentage below capacity staffing still in play. The lack of new construction in this sector and is aiding factor from a lease vacancy perspective, but many tenants are seeing an opportunity to make a fight to quality, and pricing better premises into their plans for renewal. Innovative landlords are creating work environments of the future in order to secure those better, and longer-term commitments. The commercial building sector as a result is very strong in the refurbishment and renovation of existing commercial buildings. Focus on improving end of trip facilities, shared common space with themed entertainment and hospitality offerings all feature highly.

Medical and Allied Health - One of the investment market's top picks. With ageing population and focus on health sectors and delivery options of associated health providers, this asset class has been marked a great defensive asset in many portfolios.

Regional Investment - Varying from location to location but key points to look out for include growth in lifestyle regions and ones seen to offer strong domestic tourism or employment opportunities. The downside risk that has been recently indicated in a Sydney Morning Herald interview of Coles CEO , Stephen Cain, is that some other regions may stall, based on the lack of immigration growth that had previously driven successful growth metrics.

Funds/REITs/Syndicators all took a breather during early pandemic days and are now returning strongly. Proving popular with investors, returns being offered are well above bank and other offerings for money on deposit.

Overviews are helpful, but nothing will substitute for specific and targeted market intelligence from a local agent that knows. Contact your local NAI Harcourts office to find out more about the surrounding market.